Revco’s healthcare bad debt recovery services help providers recover revenue compassionately, using patient-focused communication and proven collection strategies.

Better results by putting the patient first. Get started with a 15-minute discovery call.

HFMA’s Peer Review process provides healthcare financial managers with an objective, third-party evaluation of business solutions used in the healthcare workplace. This status is based on the effectiveness, quality and usability, price, value, and customer and technical support of the service.

HFMA staff and volunteers determined that these healthcare business solutions have met specific criteria developed under the HFMA Peer Review process. HFMA does not endorse or guarantee the use of these healthcare business solutions or that any results will be obtained.

Key Benefits

Our data-focused methodology is designed to generate additional revenue for your organization while preserving — and even strengthening — your brand reputation. When you collaborate with Revco, you’ll enjoy:

Improved Recovery Rates

Better Patient Relations

Diligent Account Resolution

Regulatory Adherence

Our bad debt programs are built on AI-powered tools that personalize outreach, predict behavior, and simplify the patient financial journey. Eliminate budget constraint and staff training issues and upgrade to Revco’s tech-enabled platform for results without the internal burden.

Without a data-driven, patient-first approach, providers often underperform on recovering aged receivables. Revco’s propensity-to-pay scoring and account segmentation ensures high-yield accounts are prioritized, boosting collection success.

Many agencies use aggressive tactics or a litigious approach that damages trust and discourages future care. The financial experience is the last touchpoint you have with a patient, and maintaining your high standard of care through the process is critical to maintaining patient loyalty. Revco’s trained agents only deliver compassionate, empathetic outreach, preserving patient goodwill while resolving debt.

Healthcare debt collections must meet HIPAA, FDCPA, FTC, and state-level requirements. Revco’s processes are fully compliant with these regulations, minimizing legal risk and ensuring ethical operations. Revco is also fully compliant with all applicable data privacy regulations. We invest heavily in cybersecurity, training, and operational protocols to ensure your patients’ data is protected at every step. To learn more about what measures we have in place, visit our Compliance & Security page.

One of the biggest challenges in healthcare collections is identifying accounts that are unlikely to pay, whether due to bankruptcy, death, or other financial hardships. Revco helps organizations efficiently move these accounts into the “bad debt” phase of the revenue cycle, reducing wasted effort and optimizing resources. We also ensure that demographic and contact information is accurate and up to date across all accounts, making it easier to reach patients and coordinate with their insurance providers. By addressing these challenges, we help health systems recover revenue more effectively while improving overall operational efficiency.

A $4B academic health system in North Carolina transitioned 100% of its Early Out, Primary, and Secondary Bad Debt inventory to Revco. The system had already partnered with Revco for more than 7 years, but their inventory was alpha split with another partner. When that partner failed to perform, the system moved its full inventory to Revco.

Revco seamlessly absorbed the full inventory within 30 days and quickly elevated results across all three service streams. This move solidified Revco as the system’s trusted, full-portfolio recovery partner.

Our culture sets us apart from our competitors as is evidenced by our average tenure. On average, medical collectors have a tenure of less than one year – at Revco, it’s 4+. In addition to our team, our IT and technology enable us to provide scalability, security, and data-driven operational intelligence. With second to none security – HIPAA HITRUST r2, SOC2 Type II, and PCI Level 1 certifications, supported by $20M in Cyber Liability – our clients know that their data is secure with Revco. Utilizing a cloud-enabled environment allows us to scale resources in real time to meet client demands, supporting rapid onboarding, workload balance across service centers, and consistent performance even during peak periods.

To stay current, Revco’s dedicated Compliance team monitors government-issued regulatory feeds and bulletins from agencies such as the CFPB, FTC, FDIC, and Federal Reserve in real time.

Additionally, the entire Revco team receives regular training through Revco Academy, our internal LMS, including regulatory training programs and certifications relevant to debt collection, data privacy, and security. This structure ensures the entire Revco team stays up to date and that our company remains fully aligned with HIPAA, TCPA, FDCPA, and federal, state, and client-specific regulatory expectations.

No. Our goal is to act as a seamless extension of your revenue cycle team. By using respectful, brand-aligned communication and offering clear payment solutions, we protect both your reputation and the patient experience—even when recovering aged accounts.

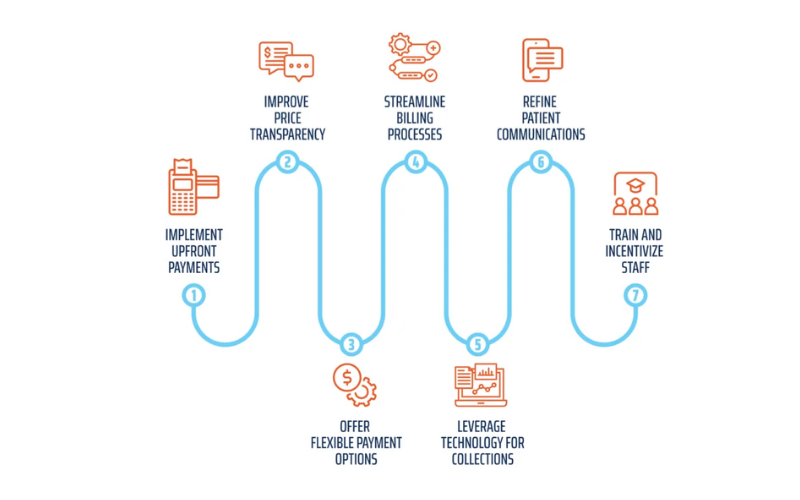

Upon placement, delinquent accounts are stratified and prioritized using a combination of balance thresholds, account age, and scoring models to determine the appropriate contact cadence and channel. We initiate outreach using a multi-channel strategy, which may include letters, outbound calls, SMS, email, live chat, and patient portal reminders. All communications are compliant with applicable federal and state regulations, and we tailor the frequency, tone, and content of outreach based on client preferences and patient demographics.

Revco provides transparent, real-time reporting and customizable dashboards that give you full visibility into collections activity, recovery rates, and patient engagement metrics so you’re always informed and in control.

We offer a comprehensive and customizable reporting package that provides clear visibility into financial performance, patient engagement, and operational effectiveness. Reports can be delivered daily, weekly, or monthly based on client preference and are available in multiple formats or through our secure client portal.

Standard reporting includes placement acknowledgements, payment and promise-to-pay summaries, liquidation and recovery performance by batch and age, call activity metrics, and work effort dashboards showing talk time, calls per paid hour, and campaign results. We also provide inventory status updates, aging reports, and exception reports for disputes, escalations, or charity care referrals.

Speed up cash flow and improve the patient finanical experience.

The most effective self-pay collections strategies are customized to your patient demographics and leverage advanced AI and machine learning to prioritize accounts and make payment easy. The best strategies strike the perfect balance between collections and compassion. Don’t just improve cash flow, build patient loyalty. Contact us today to learn more.

A quick-reference guide to clear definitions, benchmarks, actionable tips, and formulas for the most important AR terms so your team can make informed, data-driven decisions every day.

If you commit to this kind of patient-first approach in your collections efforts, both your patients and your healthcare organization stand to benefit.

It's critical to engage your patients with the right message, at the right time, through the right channel. Learn how we use propensity-to-pay scoring and charity care with our proprietary technology.