Data analytics isn’t just the foundation of success in debt collection — it’s the catalyst for ever-increasing success. Sharper analytics leads to stronger results, driving more revenue and cementing the long-term financial health of your organization.

Our economy is powered by data. The information-rich realm of revenue cycle management (RCM) is no different. To gain a competitive advantage, your organization needs to distill volumes of data into actionable insights geared toward improving collection efficiency, reducing costs, and enhancing the patient experience.

To help you achieve that advantage, Revco’s team of RCM experts has compiled the primary benefits you can expect from leveraging data in your collection efforts, as well as a handful of tips to help you maximize the power of analytics.

Let’s get started.

What Is Debt Collection Analytics?

Debt collection analytics is the process of collecting data, extracting insights from what you’ve collected, and devising strategies based on those insights to improve your collection efforts.

Crucially, debt collection analytics isn’t something you implement once — or even a handful of times — and then put on the back burner for a while. Analytics is iterative, innovative, and adaptive.

By consistently evaluating your organization’s performance, you ensure that your strategy evolves in harmony with wide-scale trends in patient behavior. This is especially vital in the realm of RCM, where patient financial experience is paramount, and expectations for friendly communications, savvy outreach strategies, and convenient payment options have never been higher.

In short: If the collections arm of your healthcare system is the engine for cash flow, collection analytics provides the fuel. With that in mind, let’s unpack the power of debt collection analytics, one benefit at a time.

Benefit 1: Creating Segments for Precise Targeting

Before you can enhance your collection efforts, you must better understand your patients. Collecting and analyzing behavioral, demographic, psychographic, and transactional data will help you answer questions like:

- How do past-due patients think?

- Which patients are the most likely to pay?

- When should we reach out to patients?

- What type of outreach would be most effective?

- What messaging and tone would resonate with patients?

Armed with the answers to questions like these, you’re ready to group like-minded customers into segments. Then, you can tailor your outreach strategy to each segment, ensuring that you reach out to the right patients at the right time using the right method — and boost collection success as a result.

Benefit 2: Identifying High-Risk Patients

If your organization is going to optimize collection efficiency, you must have an iron grip over one segment in particular: high-risk patients. Without a firm grasp on this group, you risk pouring time, money, and vital resources into the fruitless pursuit of unrecoverable debt.

But how do you know which accounts to focus on? Intuitively, it may seem like chasing accounts with the highest balance first would yield the greatest returns. However, as you’ve likely learned during your years of RCM experience, human behavior is complex. Sometimes relying on intuition leads to a dead end.

This is where collection analytics comes in. Analytical tools are immune to the biases that influence human behavior, and they’re adept at finding the “sweet spot” for effective collections — the perfect balance of total debt and likelihood to pay.

In short, analytics eliminates the human guesswork from your collection efforts.

Here at Revco, we use a proprietary “propensity-to-pay” scoring model to prioritize patient accounts for recovery. Drawing from data like payment history, credit score, outstanding debt, and more, we assign a score to each account, then reach out to the patients who are best positioned to pay, maximizing revenue for our partner organizations.

Benefit 3: Reducing Costs

Once your team has identified high-risk patients, the next step is to group them together and redirect your efforts toward patients that offer better potential for recovery. By doing so, you remove the pitfalls from the collection process and preserve resources and energy for low-risk, high-return patient accounts.

For many businesses, cost reduction is an end in itself. However, in the world of RCM, reducing costs through precise segmentation and targeting has a profound impact: it helps your healthcare system provide better care.

Implementing recovery analytics doesn’t just save you money; it allows you to create reliable financial forecasts. Equipped with that knowledge, your health system can invest in the tools and partners you need to create a world-class patient experience, from the moment they check in to the moment they pay their bill in full.

performance-driving RCM insights?

Benefit 4: Improving Efficiency

In biology, a positive feedback loop occurs when the product of a reaction catalyzes that same reaction.

When you cut your arm, your body’s first goal is simple: stop the bleeding. To do so, your body activates cell fragments called platelets, which rush to the site of the injury and begin to form a clot. As they arrive, those platelets release chemicals that activate more platelets, which activate more platelets in turn — until the clot is fully formed.

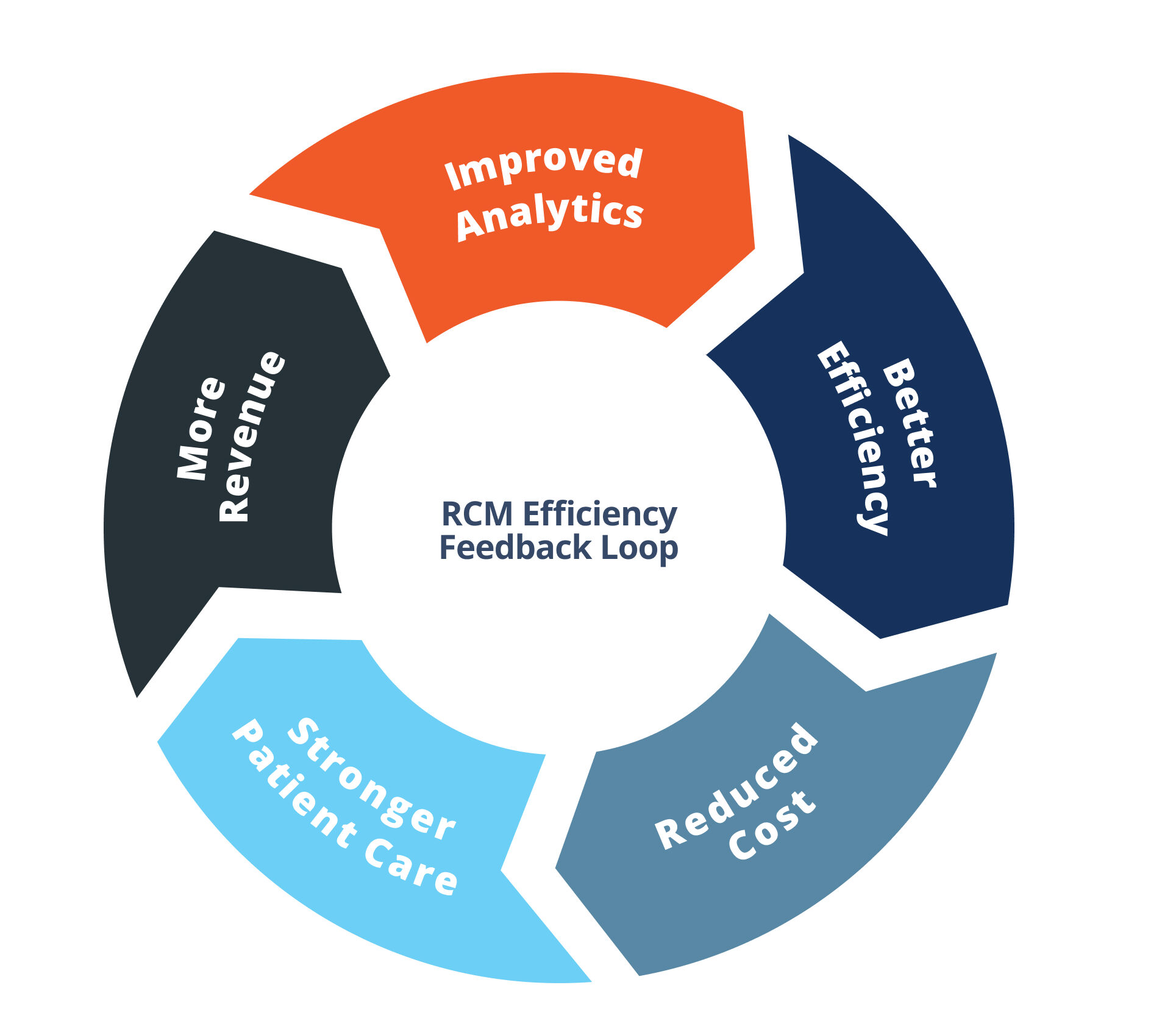

We can leverage the same principle in the realm of RCM, creating what we can think of as an efficiency feedback loop. And it all begins with activating and optimizing collection analytics.

When you implement analytics, you increase efficiency, leading to reduced costs. That extra cash allows you to provide better care, which brings in more patients and strengthens loyalty among your existing patients. In turn, those patients bring in more revenue, which allows you to strengthen your analytics, and the cycle charges forward.

Efficiency feedback loops are just like the positive feedback loop your body uses to create blood clots: except, instead of a healed cut, the outcome is skyrocketing revenue.

Benefit 5: Fine-Tuning Your Collection Strategy

Earlier, we noted that debt recovery analytics doesn’t progress in fits and starts. To keep your revenue engine humming, key metrics must be constantly calibrated and recalibrated, then worked tactfully into your collection strategy.

Here’s a quick example of how we optimize our strategy at Revco.

- Understand the patient’s financial position. Our analytics team scrubs their account, collecting data that paints a picture of where they stand financially. Do they own a home? Are they consistently and gainfully employed? Answering questions like these sets us up for success in the next phase of the process.

- Tailor our approach for maximum recovery. If a patient isn’t in a strong financial position, we may offer them a payment plan to encourage payment in full. If they’re equipped to pay, we’ll pursue payment in full right away or start them on a plan with a higher monthly payment.

Though each iteration will likely only come with tiny improvements, their cumulative power will become immense, helping your organization to gain — and maintain — a competitive advantage.

Benefit 6: Enhancing the Patient Experience

For many patients, the process of receiving healthcare feels divided: a trip to the hospital or clinic for treatment, then, many weeks later, a bill for that treatment.

Because of the time delay and the confusing nature of medical billing, there’s a wide gap between receiving care and the process of paying for it. In most cases, the former improves the patient’s view of the healthcare practice, and the latter erodes it.

Debt collection analytics can erase this gap, creating a seamless and manageable care experience for the patient from start to finish. Here’s how.

As your team gathers input (quantitatively, in the form of KPIs, and qualitatively, in the form of patient surveys), you acquire the information you need to optimize:

- Outreach channels (Text, phone, live chat, etc.)

- Messaging (What you say to encourage payment)

- Voice and tone (How you say it)

- Timing (When you reach out)

- Etc.

As you incorporate these findings into your outreach strategy, you’ll hone your ability to offer patient-centric outreach, cementing your organization’s reputation as a leader in the healthcare field and earning exceptional revenue.

Power More Revenue With a Data-Driven Approach

At Revco, our goal is simple: propelling you to unprecedented financial health while improving the financial experience of your patients.

From initial outreach to final payment, we put the patient first. During their industry-leading tenures, Revco collectors perfect their ability to connect with compassion and set patients on a steady path to payment. Then, we leverage data analysis to optimize our collection strategies, driving more revenue to your organization and keeping your reputation strong.

If you’re ready to revolutionize your success in collections, take the first step by exploring our debt collection services today. Explore Our Collection Services