On October 30, 2020, after years of extensive work and lengthy comment periods, the Consumer Financial Protection Bureau (CFPB) published its first wave of rulemaking.

The enactment of Dodd-Frank in 2010 opened the doors for this work to begin. At that time, the CFPB was created and tasked with the responsibility of enforcing federal consumer financial laws—including the Fair Debt Collection Practices Act (FDCPA)—and protecting consumers in the marketplace. In 2013 the CFPB issued an advanced notice of its proposed rulemaking, followed by a draft outline of the rules in 2016. The next four years consisted of supplemental proposals, comment periods, and consumer surveys, culminating in the final 2020 rulemaking.

These rules are the biggest development in the accounts receivables industry since the passage of the FDCPA in 1977— when we did not yet have technologies such as public internet, electronic mail, or cellular phones—and come to us in the form of a mammoth document, comprised of 653 pages of summary analysis, background and prefatory materials, rules, and official interpretations.

Too long, didn’t read? We figured as much, so we’ve put together a brief overview of the major points within the rulemaking for you. We’ve spent the last several weeks digging deep into the weeds and will continue to do so until the rules take effect on November 30, 2021, so we can be sure that our, and our clients’, practices and procedures are in compliance.

Feel like digging into the full rulemaking yourself? You can find it here.

Please note that this article does not include the CFPB’s rulemaking in its entirety and is not intended to be legal advice.

Definitions (12 CFR §1006.2)

New definitions created within the rulemaking that are worth mentioning include the terms “attempt to communicate” and “limited-content message.”

“Attempt to communicate” means “any act to initiate a communication or other contact about a debt with any person through any medium, including by soliciting a response from such person.” By adding “about a debt” to narrow the definition, the CFPB effectively excluded general marketing and advertising materials of debt collectors.

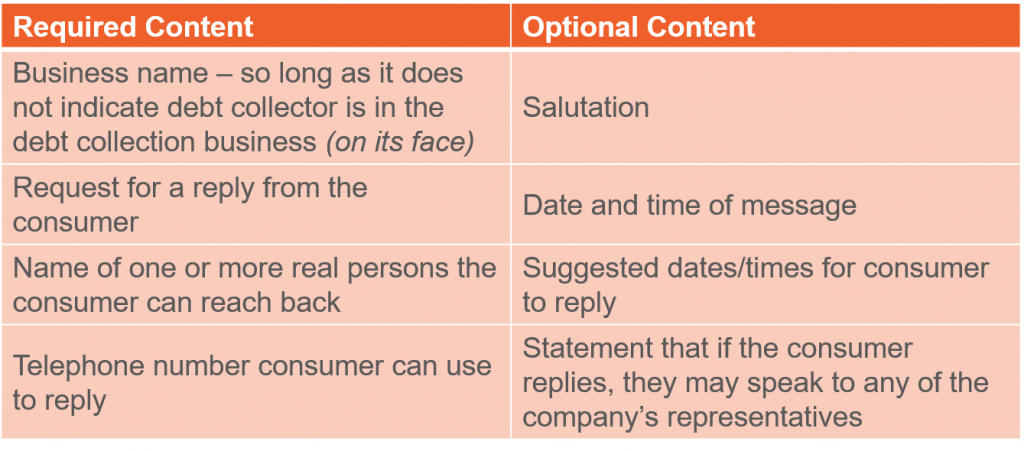

An attempt to communicate includes leaving a “limited-content message” which is defined as a voicemail message left for a consumer that contains certain required and optional content, as follows:

Note that the consumer’s name and account number are intentionally missing from both the required and option content.

Communications in Connection with Debt Collection (12 CFR §1006.6)

For purposes of communications in connection with the collection of a debt, under §1006.6(a), in addition to a consumer’s spouse, parent (if the consumer is a minor), guardian, executor, or administrator, the definition of “consumer” now also includes:

- A consumer’s confirmed successor-in-interest, and

- any “personal representative” who is authorized to act on behalf of the deceased consumer’s estate.

In addition to the statutory prohibitions and exceptions regarding communications with consumers, the new rules establish guidelines for email and text communications which, if followed, provide debt collectors with a bona fide error defense in the event of a third party disclosure.

Email The present debt collector may communicate with the consumer about the debt via an email address obtained and used by the creditor to communicate with the consumer about the account if the creditor has met certain written or electronic notification requirements to the consumer in advance of the debt referral.

Text With respect to text messages, the rules set forth both implied and express consumer consent to permit a debt collector to text consumers, along with a 60-day refreshing mechanism for debt collectors to continue to rely on such consent, by using a complete and accurate database to confirm that the consumer’s cell phone has not been re-subscribed.

Opt-Out Finally, all electronic communications or attempts to communicate must contain a clear and conspicuous notice describing a reasonable and simple method for the consumer to opt-out of such communications or attempts to that email address or telephone number. No fees may be charged and no additional information is to be required of a consumer to opt-out, other than their preference for that particular electronic communication.

The “Rule of Seven”: Harassing, Oppressive, or Abusive Conduct (12 CFR §1006.14)

The rule creates a rebuttable presumption of compliance in favor of the debt collector, so long as they:

- do not exceed 7 calls within 7 consecutive days to a person about a debt; or,

- call within 7 consecutive days of having an actual conversation with a person about a debt.

For counting purposes, day one is the day of the actual conversation. The rule does establish an exception for calls made within 7 days of receiving prior consent.

It is worth noting that attempting to communicate with a consumer through a medium they have requested not be used or opted out of (i.e. text message) is considered to be harassing, oppressive, or abusive conduct. Of course, as with any rule, there are exceptions:

- The debt collector may send a communication in that medium one more time after the consumer opts out, but only to confirm the request and state the debt collector will honor it,

- the debt collector may respond one more time if the consumer communicates with the debt collector in the medium previously requested the debt collector not use; and,

- the debt collector may communicate or attempt to communicate through a medium of communication that the person has requested the debt collector not use if otherwise required by applicable law.

False, Deceptive, or Misleading Representations (12 CFR §1006.18)

In addition to the non-exhaustive list of statutory conduct deemed false, deceptive, or misleading, the rule clarifies that if the debt collector’s initial communication with the consumer is oral, the debt collector must make the required disclosure in §1006.18(e)(1) known in our industry as the “mini-miranda” again in its initial written communication with the consumer.

Unfair or Unconscionable Means (12 CFR §1006.22)

The rule restates the non-exhaustive list of statutory conduct deemed unfair or unconscionable, and includes additional restrictions to the use of certain media, and prohibits the following:

- Sending an email to an address the debt collector knows is provided by the consumer’s employer; and,

- Communicating through a social media platform if the attempt is viewable by the general public or the person’s social media contacts.

Other Prohibited Practices (12 CFR §1006.30)

The ruling prohibits a debt collector from selling, transferring for consolidation, or placing for collection a debt the debt collector knows (or should know) has been paid or settled, or discharged in bankruptcy.

Disputes and Requests for Original Creditor Information (12 CFR §1006.38)

The rule sets forth another new term of art — “duplicative dispute”—narrowly defined as a dispute submitted in writing within the validation period that is substantially the same as one previously submitted in the same time frame, and which the debt collector has already satisfied the statutory response requirements.

In the case where a dispute is duplicative, the debt collector may notify the consumer in writing or electronically of that determination and refer them to their previous response. This section of the rule also defines the “validation period” as the thirty days after a consumer’s receipt of the written notice of their right to dispute the debt under the FDCPA.

Sending Required Disclosures (12 CFR §1006.42)

Debt collectors who send required disclosures in writing or electronically must do so in a manner expected to provide consumers with actual notice and in a format that consumers can maintain and later access. When sending legally required notices electronically, a debt collector must also do so in accordance with the E-ESIGN Act.

The “Rule of Three”: Record Retention (12 CFR §1006.100)

A debt collector must retain records that are evidence of compliance or noncompliance with the FDCPA, starting on the date collection activity begins, until three years after their last collection activity on the debt. If those records also include phone call recordings, they must be retained for three years after the day of the call.

A Note on Official Interpretations

When reading the rulemaking in its entirety, it is important to note that official interpretations, also referred to as “comments,” carry the same weight as the rules. This commentary, located at the end of the rulemaking document, is meant to provide real-life, yet hypothetical, examples of how the rules will apply to certain factual and circumstantial scenarios and is a must-read.

Conclusion

Have questions? You can rest assured that the expert team at Revco Solutions is combing through every detail of this first wave of rulemaking to ensure not only our compliance but that of our clients. Have a specific question? Just reach out.