If your healthcare organization is like most, its claim denial rate falls between 5% and 15%. Hiding behind those percentages are hundreds of thousands, if not millions, of dollars in unrecovered revenue. The key to unlocking it? Denial management analytics.

Advanced strategies for denial prevention are becoming increasingly vital to RCM success. After reviewing 102 million hospital transactions, Change Healthcare reported a 23% increase — from 9% to more than 11.1% — in claim denials from 2016 to 2022. According to Crowe LLP’s survey of over 1,700 hospitals, more than a third of that increase came between 2021 and 2022 — and the troubling trend is likely to continue in coming years.

Here’s the good news for RCM leaders: nearly 90% of denials are avoidable. By grounding your approach in robust analytics, your organization can reclaim the revenue that’s locked behind those denials. Our team at Revco is here to show you how.

We’ll cover the common causes of claim denials, steps to mitigate each one, and how you can leverage the four types of analytics to maximize revenue for your organization. Thank you for joining us!

What Is Denials Management in RCM?

Denials management is the process of analyzing, resolving, and preventing claim denials.

Because untangling denied claims requires a great deal of time and energy, implementing a proactive strategy that stops denials upfront is a high-ROI investment. According to Experian’s 2022 report, claims management is more important than ever to healthcare providers, with 72% finding it a top priority in the wake of the pandemic.

But, before we can effectively remedy denied claims, we need to understand what’s causing them in the first place.

Common Causes for Claim Denials

Drawing from Change Healthcare’s report, here’s a look at claim denials as they relate to the three phases of the revenue cycle: front-end, mid-cycle, and back-end. We’ll also review the frequency of each denial type, subcategories to keep an eye out for, and most importantly, how your organization can improve in each phase.

Front-End Denials

Summary

Front-end denials occur during the initial stages of the billing process — often before a patient even sees their provider. Typically, these denials are due to errors or omissions in patient information, registration, insurance verification, and eligibility checks. This could be as simple as a misspelled name or incorrect patient address.

Frequency

49.7% of all denials

Subcategories

- Registration / Eligibility (26.6%)

- Lack of Authorization / Pre-Certification (11.6%)

- Service Not Covered (10.6%)

- Lack of Provider Eligibility (0.9%)

How to improve

Your aim should be to enhance the accuracy and quality of patient information, consistently double-check coverage and eligibility, and ensure that your claim is supported by the necessary documentation. Train your front-end staff to focus on these areas, and equip them with the technology (electronic health records, automated eligibility verification tools, etc.) needed for success.

Mid-Cycle Denials

Summary

Mid-cycle denials are based on the services or treatment rendered by a provider to a patient. If a payer determines that the care received by a patient wasn’t medically necessary, they may deny the claim. Often, mid-cycle denials occur because the payer hasn’t received the proper documentation, or they’ve deemed the documentation insufficient to establish a need for care. Occasionally, mid-cycle denials arise due to an error in medical coding.

Frequency

21.3% of all denials

Subcategories

- Medical Documentation Requested (9.2%)

- Medical Necessity (6.6%)

- Medical Coding (4.8%)

- Avoidable Care (0.7%)

How to improve

Comprehensive documentation is the key to overcoming medical necessity denials. Providers should carefully document the rationale behind treatment decisions to help establish the necessity of care and receive payment. To minimize coding errors, strong staff education and training programs should be paired with regular audits and compliance checks.

Back-End Denials

Summary

Back-end denials happen after a patient has seen a provider and the claim has been submitted to the payer. Nearly all back-end denials occur because of missing/invalid claim data or failure to meet a filing deadline.

Missing data often results in a “soft denial,” which means that your organization will have a chance to correct and resubmit the claim. A missed deadline, on the other hand, usually results in an irreversible “hard denial.”

Frequency

22.6% of all denials

Subcategories

- Missing or Invalid Claim Data (17.2%)

- Untimely Filing (5.4%)

How to improve

As with front-end denials, the remedy for most back-end denials is improved training, diligence, and quality control checks. Again, leveraging technology will boost the performance of your RCM teams: for example, electronic billing systems and automated reminder systems to ensure timely claim submission.

performance-driving RCM insights?

Types of Analytics in Denials Management

Claim denials are complex. In the previous section, we touched on 10 subcategories for claim denial types in the three phases of the revenue cycle — and we didn’t even consider the unique dynamics for your specific healthcare practice and assortment of payers.

Thankfully, the burden shouldn’t fall squarely on your own shoulders. A layered challenge like denials management is best met by a layered solution: denials management analytics. As is often the case in business, a greater understanding of a solution (in this case, analytics) leads to stronger implementation of that solution, which in turn fuels greater success (in this case, fewer rejections and more revenue).

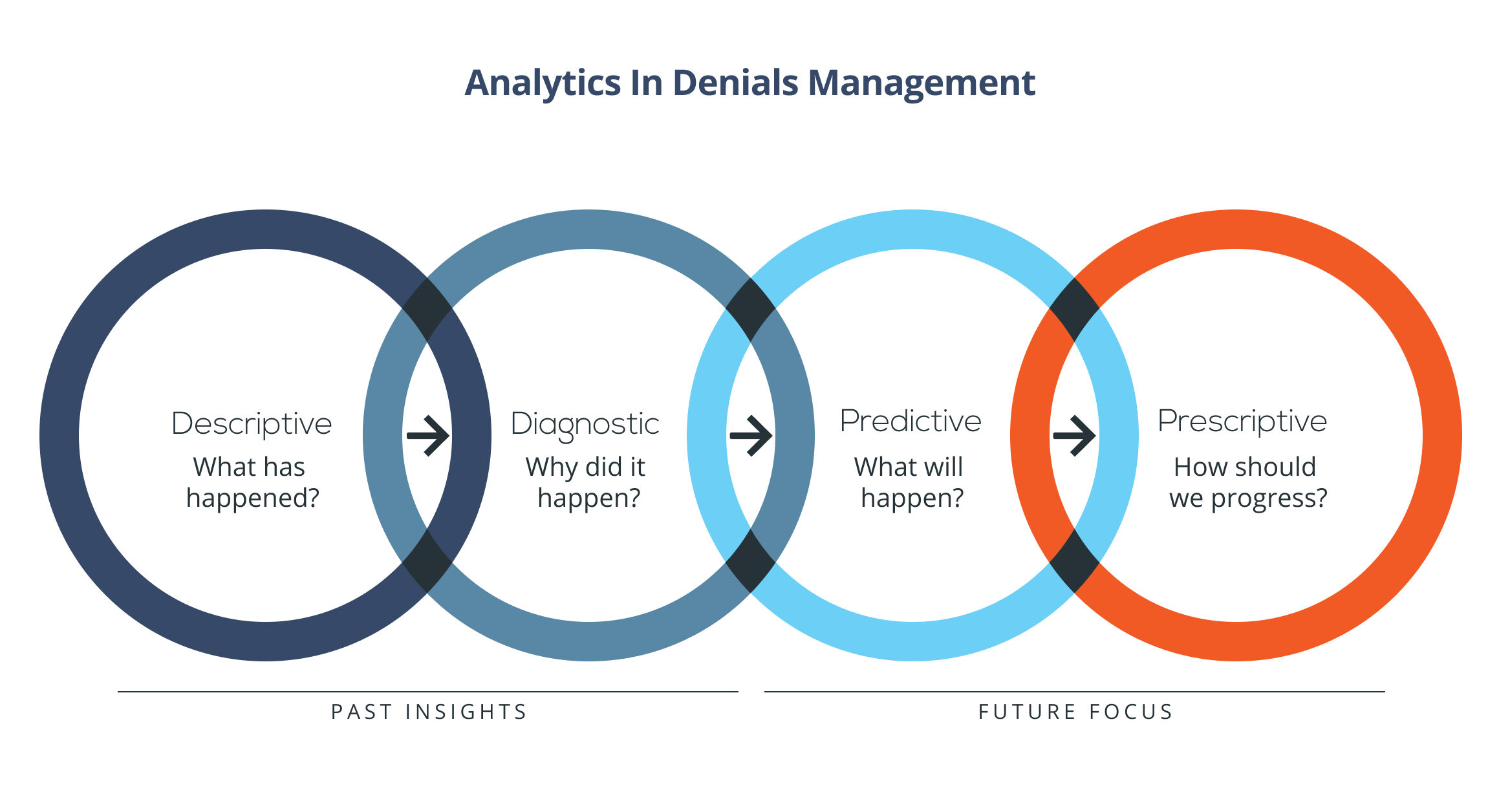

With that in mind, let’s refresh our understanding of denials management analytics by walking through the essential varieties: descriptive, diagnostic, predictive, and prescriptive.

Descriptive Analytics

Descriptive analysis uncovers trends from past data.

A wealth of actionable insights are hidden in your existing denial data. Descriptive analytics is geared toward extracting those precious insights, helping you answer questions like:

- Why are our claims getting rejected?

- What types of claims are rejected most frequently?

- Which payers have been most likely to reject claims?

- Which medical codes most commonly result in denials?

Descriptive analytics is the first step to optimizing your denials management process. It’ll illuminate the areas where work needs to be done, allowing you to make precise, impactful adjustments.

Diagnostic Analytics

Diagnostic analysis dives deep into the root cause of denials.

In many ways, diagnostic analytics is a subset of descriptive analytics. Where descriptive analytics may stop at the analysis of wide-scale denial trends, diagnostic analytics gets into the low-level details, emphasizing questions like:

- What specific information is most frequently missing from individual denied claims?

- Are there any patterns beneath our coding errors?

- How do documentation requirements shift for each payer and billing code?

Descriptive and diagnostic analytics work together to form a foundation of past insights. Moving into the next types of analytics, we shift our focus to the future.

Predictive Analytics

Predictive analysis projects future claim denials.

Armed with insights from descriptive and diagnostic analytics, your organization is ready to pivot to questions like:

- What claims are most likely to be rejected in the future?

- Which payers are most likely to respond favorably to appeals?

- How much money is our denials department likely to spend on medical necessity denials in Q3?

Once your team has completed its review of past information and made data-informed projections in the form of predictive analytics, it’s time to bring each branch of analytics to bear using prescriptive analytics.

Prescriptive Analytics

Prescriptive analysis recommends the best strategy going forward.

In short, it’s where the rubber meets the road. Drawing from the insights you’ve already uncovered, you can answer the most important question:

- How do we turn what we’ve learned into improvements that meaningfully impact our bottom line?

Depending on what you’ve uncovered during the descriptive, diagnostic, and prescriptive phases of investigation, this might look like:

- Investing in technology that checks for information errors in real time,

- Training staff to prioritize eligibility checks,

- Enhancing your documentation procedures for one particularly picky payer, or

- Implementing a reminder system to prevent your team from missing filing deadlines.

By investing heavily in each arm of denials management analytics, you pave the way for greater success in appeals, lower denial rates, and most importantly, unprecedented revenue for your organization.

Benefits of Analytics in Denials Management

As you implement denials management analytics, you may see a short-term spike in revenue. The true advantage of analytics, though, is its ability to drive sustainable growth.

With proper execution and frequent refinement, analytics will:

- Improve the accuracy of your claim submissions. Analytics will shed light on common stumbling blocks for your organization: coding errors, documentation gaps, repeated trouble with a certain payer, and other common culprits behind denials. A strong understanding of these issues empowers you to make targeted improvements.

- Streamline denials management processes. RCM generally — and denials management specifically — is inundated with data. Automated analytical tools can rapidly survey vast quantities of data, prioritizing high-ROI denials while reducing the workload on your staff.

- Proactively prevent denials. In the realm of denials management, an ounce of prevention is worth thousands of dollars. By pinpointing the root cause of denials and predicting which payers, procedures, and diagnoses are likely to cause the most trouble, analytics helps you stop denials at the source.

- Calibrate your processes as you go. Whether you belong to a national health system or a small physician group, continuous optimization is the key to staying ahead of the curve. When you consistently check in with your analytics, you’re sure to keep the competitive advantage.

- Strengthen relationships with payers. The foundation of reimbursement is the provider-payer contract, and the terms of that contract hinge in part on the relationship you uphold with a particular payer. Analytics gives you the ammunition needed to have constructive conversations that include favorable contractual terms.

- Maintain compliance and achieve regulatory adherence. Automated tools are crucial when it comes to achieving compliance. Data analysis will flag areas of concern so your team can correct them instead of incurring penalties for a compliance violation.

- Create strategic, data-informed plans. Though analytics will help you optimize your denials management strategy right away, its true value is long-lasting. Denials management analytics will set you up for increased revenue, operational success, and outstanding financial health.

Denials Management Analytics: Next Steps for Your Organization

As an RCM leader, we’re sure you’re familiar with the typical framework for implementing analytics: define goals, gather data, identify KPIs, and so on. Instead of reiterating each step, we’ll call out the three-step framework you should use to improve your efficiency in the coming months.

- Identify improvements that must be made, and divide them into two categories: tech-driven and people-driven.

- For areas that require technology, evaluate a handful of tools, then incorporate the best one into your process.

- For areas that require human solutions, rigorously enact training programs with carefully defined goals.

Naturally, this framework is oversimplified, and many improvements will depend on the combined efforts of your people and your technology. But fundamentally, enhancing your denials management system means upgrading your tools and educating your people.

Remember: The most important aspect of RCM growth isn’t the exact formula you use for improvements. It’s marshaling the strength to begin your analytics initiative and the grit to push through roadblocks as you progress. With time, your determination will be rewarded.

Prevent Denials and Win More Appeals With Revco

Often, the key to unlocking unprecedented success in denials management is finding the right partner. Our team at Revco would love to help enhance your processes and drive more vital revenue to your organization.

Whether a denial is newly active, aged, or closed, we’ll step in with diligence and skill to guide it to a positive outcome. Most importantly, we’ll flag areas for improvement and offer strategic advice on preventing denials before they happen.

Let’s work together to build the foundation for sustainable, data-driven revenue cycle performance. Explore our denials management service.