Denials are more than just a financial nuisance — they’re a red flag waving from deep within your operations.

According to AHA’s 2025 Environmental Scan, nearly 15% of all claims submitted to private payers for reimbursement initially are denied — a staggering figure that highlights a persistent and costly challenge in the healthcare revenue cycle. The “why” in how this happens varies greatly among healthcare organizations. While it’s easy to chalk this up to insurers being difficult or overly bureaucratic (and sometimes, that can be true), that assumption often masks deeper issues. In reality, every denial is a data point signaling a process breakdown in your revenue cycle operation.

Instead of treating denials as isolated revenue hits to work and resubmit, frame them as symptoms of underlying operational inefficiencies. By shifting to this perspective, healthcare leaders can transform denials management into a strategic opportunity for uncovering and resolving the root causes eroding revenue, performance, and the patient experience.

In this article you’ll discover how to use data from your denials management practices to uncover potential broader operational issues like staffing gaps, lacking technology, inefficient workflows, or training shortfalls and resolve them to prevent future revenue losses.

Diagnose Your Financial Health

Think of denials as the x-ray of your revenue cycle’s health—they reveal the underlying issues that may be impacting your financial performance. Just like an x-ray provides a diagnostic snapshot to guide clinical decisions, denial data offers valuable insight into operational inefficiencies, compliance gaps, and process breakdowns. With this clarity, healthcare organizations can make informed, targeted decisions to correct course and strengthen their revenue integrity. However, identifying the issue is only the first step; unlike a simple diagnostic scan, resolving denials often requires a deeper dive into workflows, payer policies, and documentation practices. In our experience, four denial reasons consistently rise to the top as the most common culprits:

- Eligibility verification: Failure to accurately verify a patient’s information, insurance coverage, and benefits before services are rendered can lead to claim denials, delayed payments, or patient billing disputes.

- Missing authorization: When required prior authorizations are not obtained before services are provided, claims are often denied outright.

- Coding errors: When incorrect or incomplete diagnosis or procedure codes are assigned to a claim, it can lead to denials, delayed payments, or potential compliance risks.

- Timely filing: Front-end inefficiencies causing late claim submission risk automatic denials.

Later, we will dive deeper into how you can ultimately reduce these errors, but first we need to look at exactly how it’s impacting your healthcare organization.

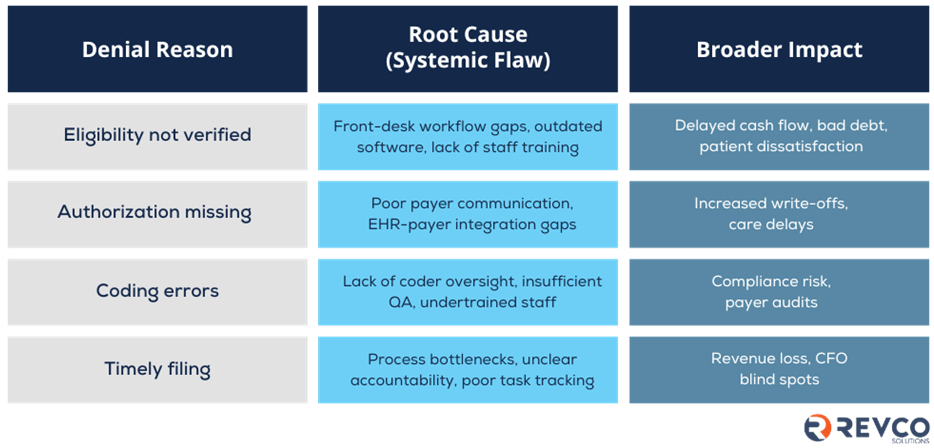

This chart below details each denial reason from above and an example of the systemic flaw it may be rooted in. Then, it describes the broader impact to the overall financial health of your revenue cycle.

How can you identify these bottlenecks for your own healthcare organization? Let’s start with these three steps:

- Track: Identify your top five denial reasons by payer.

- Map: Work inter-departmentally to trace those reasons to specific touchpoints in your organization’s workflow. This will help you identify the true root cause(s). As you work through it may help to think of your labels as one of the following: people, process, or technology.

- Act: Prioritize treating each “diagnosis” based on the financial impact and effort to resolve.

How to Reduce Claim Denials in Your Medical Practice

As we’ve identified, claim denials are as much a financial risk as an operational headache. Frequent denials can lead to cash flow issues and hinder net patient revenue, resulting in lost opportunities for growth. In fact, according to a recent report by the AHA, fighting claim denials from commercial insurers cost providers $19.7 billion annually, with the average cost to appeal a single claim as high as $50.

What’s more revealing is that 54% of these denials are eventually overturned—but only after providers engage in time-consuming and resource-draining appeals. Unfortunately, most healthcare organizations can’t afford to operate with unlimited administrative bandwidth.

The key, then, is not just fighting denials—but preventing them. To ensure your revenue cycle remains uninterrupted, it is essential to reduce time and resources spent on resubmitting denials.

Here are several actionable strategies you can implement into your operation to combat the four most common types of denials we identified earlier:

- Eligibility verification: Use automated tools to verify insurance coverage and benefits before the patient arrives, reducing the risk of coverage-related denials.

- Missing Authorization: Create a centralized, current payer-specific authorization guide to help staff understand which services require authorization based on payer rules, preventing missed requirements.

- Coding errors: Invest in coder training and continuing education. Additionally, use coding software with built-in compliance checks to catch common errors or inconsistencies before claims are submitted.

- Timely filing: Standardize internal workflows with defined timeframes for claim processing. Establish clear timelines from date of service to claim submission to prevent delays and missed filing windows.

By identifying your most common reasons for claim denials and implementing effective strategies, you can safeguard your healthcare organization’s financial health. Through our expertise, we ensure that your denials management practices and ultimately, your entire revenue cycle, is not just managed but optimized for long-term success. If you need more assistance, RCM companies like Revco Solutions offer denials prevention services like preemptive claim scrubbing, appeals processes, denials tracking system, and more. Ask us about how we can help your healthcare organization manage denials.

Ready to enhance your billing process? Revco Solutions partners with healthcare organizations to modernize RCM with patient-centric technology and expert support. Discover how we can help streamline your revenue cycle.