The amount of data available to healthcare revenue cycle management (RCM) departments can be overwhelming—especially if you don’t have a robust analytics system that allows you to make sense of those millions of data points.

When you do have an analytics system that works for you, however, data can become the fuel for your revenue cycle engine. You’ll be able to identify the bottlenecks and inefficiencies that are lengthening your revenue cycle, decrease denied claims, better understand and predict patients’ payment behavior, and plenty more.

Let’s take a closer look at how data analytics can support your RCM team throughout the entire revenue cycle.

Understanding the Fundamentals of RCM Data

While your healthcare organization is likely collecting data on a huge number of interactions, there are specific types that will be more useful than others to RCM staff. From the moment information enters your systems to the moment you act on data-backed insights, here’s how you can get the most out of your data.

Sources of RCM Data

Electronic health records (EHRs), billing software, external databases that your organization uses, and payer claims information are all sources of critical data for RCM departments.

How spread out this data is—whether it’s contained in a few internal databases, or distributed across multiple internal and external locations—will determine how and whether your varying data sources can be integrated into a single source. There are pros and cons to migrating and integrating data, and these projects can be time-consuming. But that’s a subject for another blog post!

Types of RCM Data

While the exact data types that will be most useful to your RCM department will vary based on the size of your organization, your population mix, your specialties, and other factors, you should be collecting and analyzing data in these key areas:

- Claim denials and underpayments

- Patient demographics

- Patient payments

- Patient access

- Patient satisfaction

- Coding and billing

- Revenue and profitability

- Industry benchmarking (i.e. how your healthcare organization’s metrics compare to industry standards)

Data Quality and Confidence Levels

Of course, the insights offered by a data analytics program can only be as good as the data that went into it. If your data is unreliable or outdated, it won’t be able to effectively inform decision-making.

This is why it’s so important to engage in data validation processes before you start the analytics process. Data validation is the process of identifying whether the data you have is complete (all applicable fields are filled out), updated (when it was last input), and whether any information is redundant or inconsistent.

Here at Revco, one of the data validation steps we take for our clients is an NCOA scrub, which checks for outdated address information. We also work with our partners to update patient phone numbers, increasing the likelihood of first-call contact.

It can be tempting, at times, to simply assume that validation isn’t needed. But when you consider the impact that poor data can have on your revenue cycle down the line, patient contact success, and more, it becomes clear that data validation is an essential step.

If you’re working with a massive data set, you can choose a sample to validate. This is a best practice that ensures you can obtain a solid confidence level of how accurate your data is, without pouring excessive amounts of time and effort into the process.

There are several data validation tools available on the market that will take these steps for you, but it’s also possible for your IT department to perform this step using a scripting language.

And like everything else, data validation isn’t a “set it and forget it” step. Unless you regularly validate and review your datasets, they will age—meaning the value they provide your organization will steadily decrease.

Utilizing Data for Insightful Analytics

How does this raw data turn into actionable insights?

This is precisely where the “analytics” part of data analytics comes in. Analytics allows you to track, analyze, optimize, and even predict trends and patterns that can then be used to improve decision-making.

Consider something like patient satisfaction, which has an outsized impact on performance-driving KPIs like your Gross Collection Rate. If your patient satisfaction is dipping over time, that’s not only an indicator that your billing staff may need a refresher in customer service, but it could also indicate that you should track your Gross Collection Rate or another revenue collection metric.

performance-driving RCM insights?

Transforming RCM with Data Analytics

Let’s take a look now at some ways that healthcare revenue cycle analytics can have a positive impact on your bottom line.

Enhancing Denial Management

Denial management, or the reduction of insurance claim denials, is a central element of revenue cycle processes. Claim denial rates can range from between 5-15 percent annually, which can result in millions of dollars of lost revenue for the average hospital.

That’s not to mention the investment of staff time and energy that is required to work through the claims denial process. And while your claim denials rate will never reach 0, your RCM team should certainly take steps to reduce your denials rate.

Data analytics can be instrumental here. By analyzing the trends and patterns that emerge in the type of claim, payer, and reason for denial, healthcare organizations can identify the most critical areas to focus on in order to reduce that denial rate.

For instance, you may find that coding errors account for 27 percent of your claim denials. With this information in hand, you can confidently take action to address the issue, whether through additional staff training, clarifying specific medical codes with a payer, or identifying a systems glitch or problem that may be contributing to the errors.

With the consistent application of data analytics, your RCM team will be empowered to take proactive steps toward mitigating coding and any other issues that are contributing to claims denials.

Improving Patient Collection Strategies

Patients today want a personalized, seamless financial experience—and without revenue cycle analytics, you’ll be hard-pressed to deliver.

With the insights offered by analytics, healthcare providers can identify patients who would be eligible for financial assistance, provide tailored payment plans, and offer a more compassionate and informed approach to the collection process. This, in turn, can help increase the number of accounts that are settled in a timely manner, shortening your revenue cycle.

Operational Efficiency and Resource Allocation

Data analytics doesn’t only enhance your external-facing functions, like interacting with patients and payers. It can also help identify areas within your organization that can be improved.

Streamlining RCM Workflows

Analytics can show your team where the bottlenecks in their processes are and shed light on areas that create a heavy administrative burden. Does a certain payer take longer to respond to claims than others? Are staff spending lots of time on a task that could be automated?

When these points are made clear through analytics, your RCM team can take effective action to streamline their workflows and improve operational efficiency.

Effective Resource Allocation

Many healthcare RCM teams are stretched to the limit—in fact, a recent study found that 63 percent of healthcare providers are struggling with RCM staffing shortages (which is one of the most important emerging trends in RCM in 2024).

When the efficient use of staff resources is so vital, the power of data analytics cannot be overlooked. When RCM team leaders can identify where staff are most needed and where their skills are not being used efficiently, they can help increase productivity while decreasing the risk of employee burnout.

Revenue Forecasting in RCM

With predictive analytics, RCM teams can anticipate and prepare for potential outcomes in a variety of areas.

Predictive Analytics for Revenue Forecasting

Revenue forecasting may be one of the most useful uses of predictive analytics, allowing RCM teams to gain an idea of where revenue may be in a month or a year given their current situation.

Healthcare RCM departments can also use predictive analytics to predict future costs, foresee potential challenges, and identify anomalies and outliers that could create financial risk.

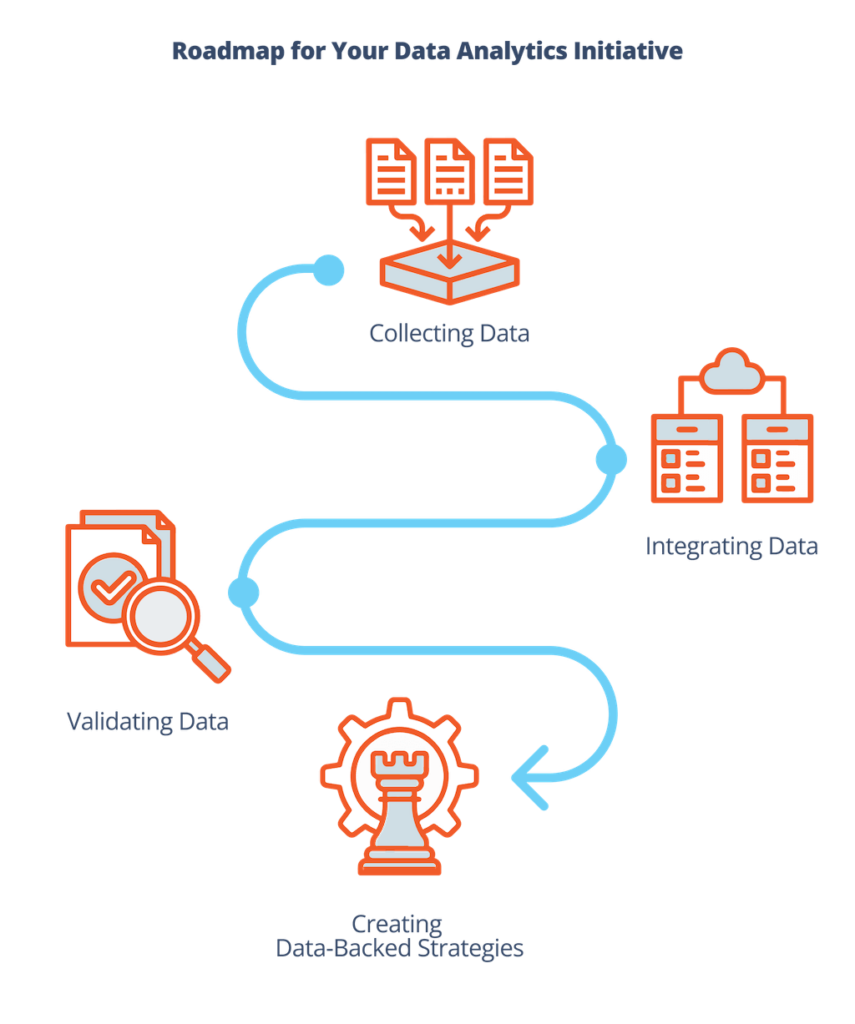

The Roadmap to Implementing Data Analytics in RCM

Implementing data analytics need not be an all-encompassing project. While the following roadmap will apply to any area in which you decide to integrate data analytics into your RCM processes, it may work better to start small—choose one critical area where analytics can make a significant difference, and continue adding from there.

Data collection, validation, and integration

The first steps your RCM team will need to go through are data collection and data integration.

Data collection is the process of gathering and extracting data from various sources, such as:

- Patient billing records

- Patient health records

- Claims and payer records

- Patient demographic data

- Patient satisfaction surveys

This is also the point at which you’ll need to validate the data and ensure that it is high-quality. If it isn’t, your team will need to decide what kind of remediation steps to take, from working with other departments to clean up the data to finding additional data sources.

Data integration involves bringing the datasets you have collected together into a single (or a few) database(s). This requires standardizing the data’s format and structure, scanning for redundancies, and ensuring that different systems can communicate with each other.

Translating Data into Actionable Strategies

Here’s where the rubber meets the road.

Once you’ve implemented your systems, it’s time to begin actually analyzing what your data is telling you, allowing you to identify areas for improvement and areas where your team is succeeding. (Remember: Highlighting where your team is succeeding is essential—it drives productivity and reminds them that analytics is there to support them in their role.)

You’ll want to begin by prioritizing specific KPI or financial performance metric goals: for example, reducing your time to collect by 10 percent over the next six months.

Then, you’ll need to check your data analytics related to patient demographics, payment activities, and other potentially relevant areas to see if any patterns or trends emerge.

From there, you can decide on the right course of action to move your team closer to the goal. Maybe that’s introducing incentives for payments made earlier than 30 days, or being more proactive about offering payment plans for patients who are struggling to pay.

Revco’s Approach: Data-Driven RCM Optimization

At Revco, we take a data-driven approach to everything we do for our clients while maintaining a patient-centric model that places a premium on your patients’ experience.

We incorporate best-in-class business analytics into our processes and work with our partners to obtain their most up-to-date patient information. Then, we leverage this information to maximize your cash flow, whether that’s by guiding patients to payment, taking proactive steps to improve your Early Out processes, or speedily resolving denied claims.

We would love to partner with you through our patient-centered early out, debt collection, and denials management services. If you’re ready to pursue unprecedented financial health, start a conversation with us today.