As debt ages, it becomes increasingly difficult to collect. Integrating your Early Out services with technology — both in your processes and by offering virtual payment options — is the key to settling accounts swiftly and minimizing bad debt.

According to Instamed’s latest report, 77% of consumers expect virtual and self-service options to be offered in healthcare, but 78% of providers primarily collect from patients with paper and manual processes. In other words, there’s a fundamental disconnect between how patients want to pay and how healthcare organizations are asking them to pay.

At Revco, we’re committed to staying on top of the latest technologies to drive RCM efficiency and improve patient satisfaction. In this piece, we’ll walk you through key tech advancements in RCM, explain their benefits for providers and patients alike, and give real-world examples of technology-driven success in revenue cycle management.

Let’s explore how technology can set you up for unprecedented success in Early Out collections.

Early Out vs. Bad Debt Collection

Before we jump in, we’ll address a question that arises even in high-performing RCM departments: When does Early Out collection become bad debt collection?

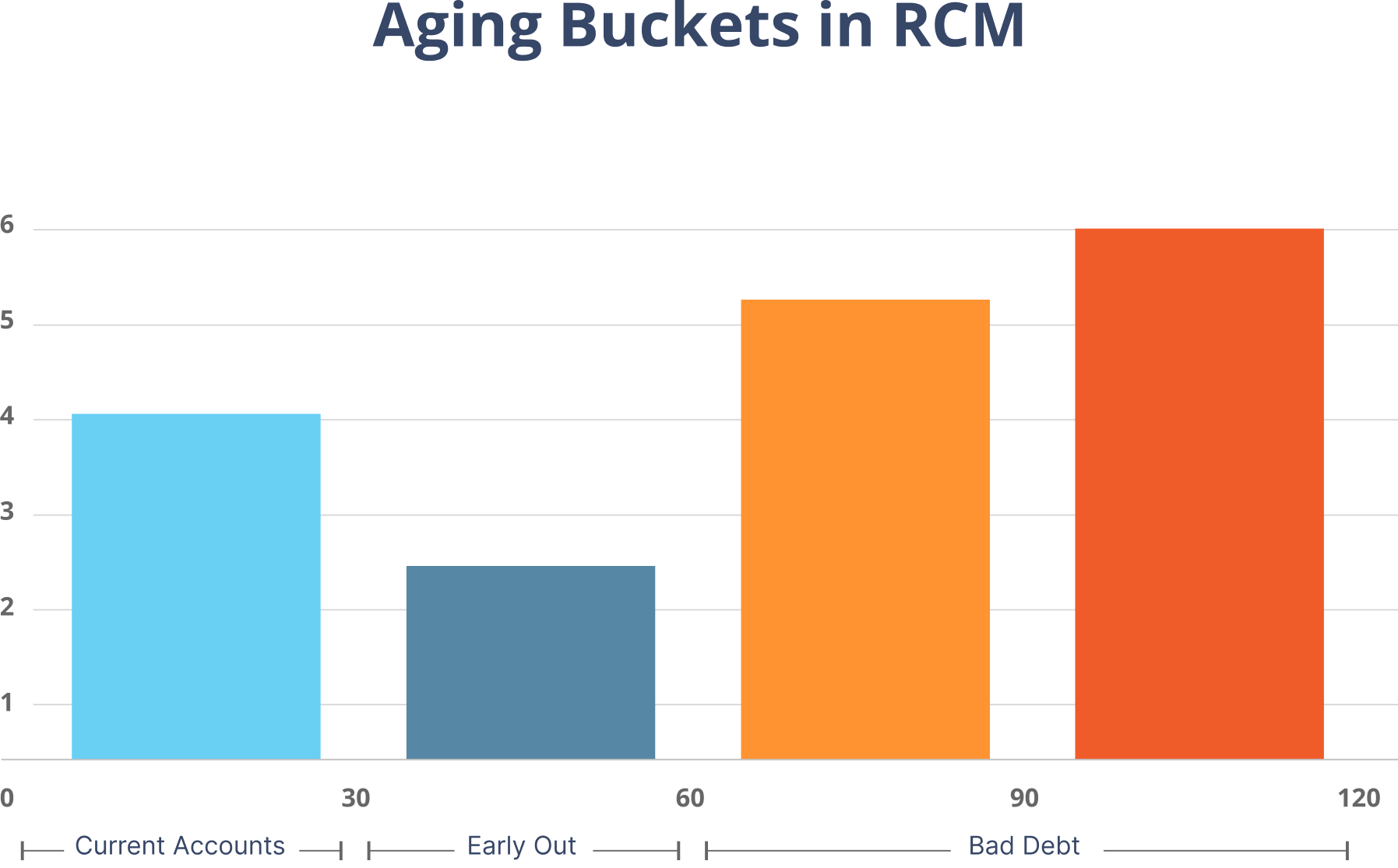

The short answer: In most RCM operations, Early Out collections focus on debt that’s between 31 and 60 days old. Accounts that are younger than 31 days are in a good place; accounts that are older than 60 days are typically considered “bad debt.” Naturally, RCM teams should aim to resolve accounts as early in the aging cycle as possible to avert large amounts of hard-to-recover bad debt.

One of the most important metrics to track to optimize RCM efficiency is Aged Accounts Receivable (A/R) Rate. As debt ages, it can be grouped into the following “aging buckets”:

- 0-30 days

- 31-60 days

- 61-90 days

- 90+ days

Aged A/R Rate indicates the percentage of A/R that falls in a specific bucket. Lower percentages (especially in older buckets) reflect a healthier billing cycle.

Key Technological Advancements in Early Out Collections

In the past, Early Out collection was completed manually, and it required mountains of paperwork. Due to the sheer volume of patient accounts and communications, errors were far more common, reducing the efficiency of the billing cycle.

Recently, as technology has charged forward, more and more RCM departments are automating their processes (or finding a balance between manual labor and automation).

Here are a few of the key ways that Early Out approaches are evolving alongside technology.

Automation in Patient Billing and Communications

New tools are ensuring that patients receive the right bill at the right time. In an industry where 71% of consumers are already confused about their medical bills, reducing errors in billing is a crucial piece of improving the patient financial experience and facilitating on-time payment.

In the spirit of receiving payment on time, technology can also be used to create payment plans for patients who aren’t able to pay in full and send out reminders when a patient’s payment date is coming up (or overdue).

This flexibility in payment, coupled with persistent reminders, contributes to your effectiveness in Early Out collections and positions your organization for success if that debt ages past 60 days

Leveraging Data Analytics for Personalized Approaches

Tech-driven data analytics — both in Early Out and bad debt collection — is a vital component of your organization’s revenue cycle. Where automation in certain patient interactions can reduce error rates and directly improve the patient’s payment experience, data analytics works its magic behind the scenes to optimize those interactions.

When it comes to collecting payment, personalization is a powerful ally. Here are two ways our team at Revco uses technology in our Early Out program to tailor our services to a patient’s preferences and financial position:

- Our propensity-to-pay scoring model: Drawing from over 200 million consumer credit files, we highlight accounts that are likely to pay and focus our outreach efforts on them. Then, we adapt our approach based on what we hear from patients: if they’re in a stable place financially, we secure payment in full; if they’re struggling, we offer a payment plan or guide them to financial assistance.

- Our workflow-based collection programs: Our software utilizes workflows that dictate whether we send digital or paper communications to a patient, based on their preference. Connecting with patients in the manner they prefer is the best way to maximize payment, no matter which “aging bucket” you’re targeting.

performance-driving RCM insights?

The Benefits of Technology in Early Out Services

Creating happy, healthy patients — from the moment they reach out for care to the moment they make their final payment — is the only way to grow sustainably as a healthcare organization.

Technology will help you do just that. In this section, we’ll review the two primary benefits technology can unlock in your Early Out and self-pay programs.

Improving Patient Engagement and Satisfaction

The patient experience is more important now than ever. According to J.P. Morgan’s 2023 report, 42% of consumers would switch providers based on their payment experience. Even if a patient is receiving excellent healthcare from your organization, almost half of them will switch providers if they have an unpleasant payment experience!

At Revco, our strategic Early Out services are built to make payment easy. We do this by:

- Offering a wide range of channels for communication. Call, text, email, or live chat: our collection agents are trained to reach out to patients in the manner they prefer to take stress off their shoulders.

- Listening and responding with compassion. Our agents recognize that paying for healthcare can be overwhelming. We take the time to truly listen to patients’ concerns, offer an understanding voice, and ultimately, help them find a manageable path to payment. Not only does this lead to more positive outcomes — it maintains the trust you’ve built with your patients.

- Giving patients a voice in the collection process. Patients are the source of truth around what works and what doesn’t work in Early Out collection. Revco consistently fields input from patients so that we can calibrate our approach to best meet their needs and desires.

Enhancing Financial Performance and Efficiency

Technology is the basis of data analytics, which is an RCM organization’s strongest tool for elevating performance. Data analytics can turn volumes of data into actionable takeaways through:

- Descriptive analytics, which tells you what has happened in the past,

- Diagnostic analytics, which illuminates why it happened,

- Predictive analytics, which projects what will happen in the future, and

- Prescriptive analytics, which highlights the best next steps to take.

Viewed through these four lenses, technology can improve your Early Out collection efforts by helping you connect with the right patients in the right way at the right time.

Improving Outcomes: Revco’s Early Out Technology in Action

Of the KPIs that every healthcare collection department should track, call metrics are the most commonly overlooked. Here are some examples of call metrics:

- Average Wait Time (how long a patient waits before receiving assistance)

- Right Party Contact (RPC) Rate (how often your calls reach the intended recipient)

- Average Payment Per Call (how much money you receive from patients each call)

In an effort to tighten our call metrics in Early Out and bad debt, our team recently implemented a service that monitors the status and display of caller ID phone numbers. It gives us insight into what numbers are:

- Being blocked,

- Being mislabeled as spam,

- Missing the caller business name, or

- Displaying an inaccurate caller business name.

Technology like this is particularly crucial in an Early Out environment because patients are far more likely to answer a call that comes from a hospital they’re familiar with. Since enacting this new technology, we’ve improved our RPC rate by 20%, which increases our ability to collect payment accordingly.

Elevate Your RCM Performance with Revco’s Tech-Enhanced Early Out Services

At Revco, we understand that technology is best used as a complement to real human interaction — not a replacement.

We personalize and streamline our Early Out efforts using tech-driven data analytics and error-free automated processes. Then, we count on our deeply trained and highly knowledgeable collection representatives to provide the “human touch” — the empathy and understanding that guides patients to payment and boosts your brand reputation.

If you’re interested in partnering with an Early Out team that strives for the perfect balance between tech-optimized and person-driven collections, explore our Early Out services today.