Text, email, live chat, self-service portals—these are the methods that most of your patients are using to communicate with the businesses they engage with.

When it comes to their healthcare providers, they expect the same options. Many healthcare organizations have adopted electronic communications for things like appointment reminders and scheduling requests, but when it comes to electronic payment options, too many in the industry are lagging behind.

According to a recent survey by Salucro Healthcare Solutions, 59 percent of respondents said they would prefer a text message payment reminder over a call or email. That same survey found that only 11 percent of respondents had a text-to-pay option from their healthcare provider, while just 32 percent had received an online payment option.

There are many reasons that patients prefer having these options, from the ease of use to personalization. But there are also real advantages for revenue cycle management (RCM) teams aiming to shorten their revenue cycles and increase cash flow through payment collection.

Here’s how your organization can leverage digital channels to make the most of every patient interaction.

Personalization in Patient Communications

Personalized communication is key to developing strong, trusting relationships with patients, which is why our team at Revco aligns our collection practices with each patient’s preferred outreach method and unique circumstances.

“A personalized connection goes far in collecting a debt. No one likes to think they’re a ‘number.’” –Revco Leadership Team

This begins with the patient’s initial contact with your organization and doesn’t end until they’ve settled their bill and you’ve closed out that account.

But often, the only contact a patient has with their healthcare provider about billing is in the form of mailed bills. Not only do these feel impersonal, they can also cause increased stress—a YouGov survey found that 40 percent of people think their medical bills are extremely or somewhat confusing. What’s more, they’re also more easily ignored by the recipients.

Electronic communications, on the other hand, can be personalized in several ways to make the billing and debt collection process easier, faster, and less onerous for patients.

However, simply allowing patients to choose the method by which you contact them isn’t enough: a critical aspect of personalization is opening up two-way communication. This means giving patients ways to engage with you throughout the billing and collection process, whether by choosing a payment plan option that is developed based on their specific circumstances, or having the opportunity to speak with agents via chat, SMS, or phone.

With access to the right patient data, as well as a robust predictive analytics system, communication can be adapted in ways that match or predict patient preferences.

While these changes aren’t fast or easy, they are worthwhile. Healthcare organization RCM teams that implemented data-driven patient engagement methods, including digital channel communication, saw a 30 percent increase in revenues from patient billing.

Strategic Use of Digital Channels

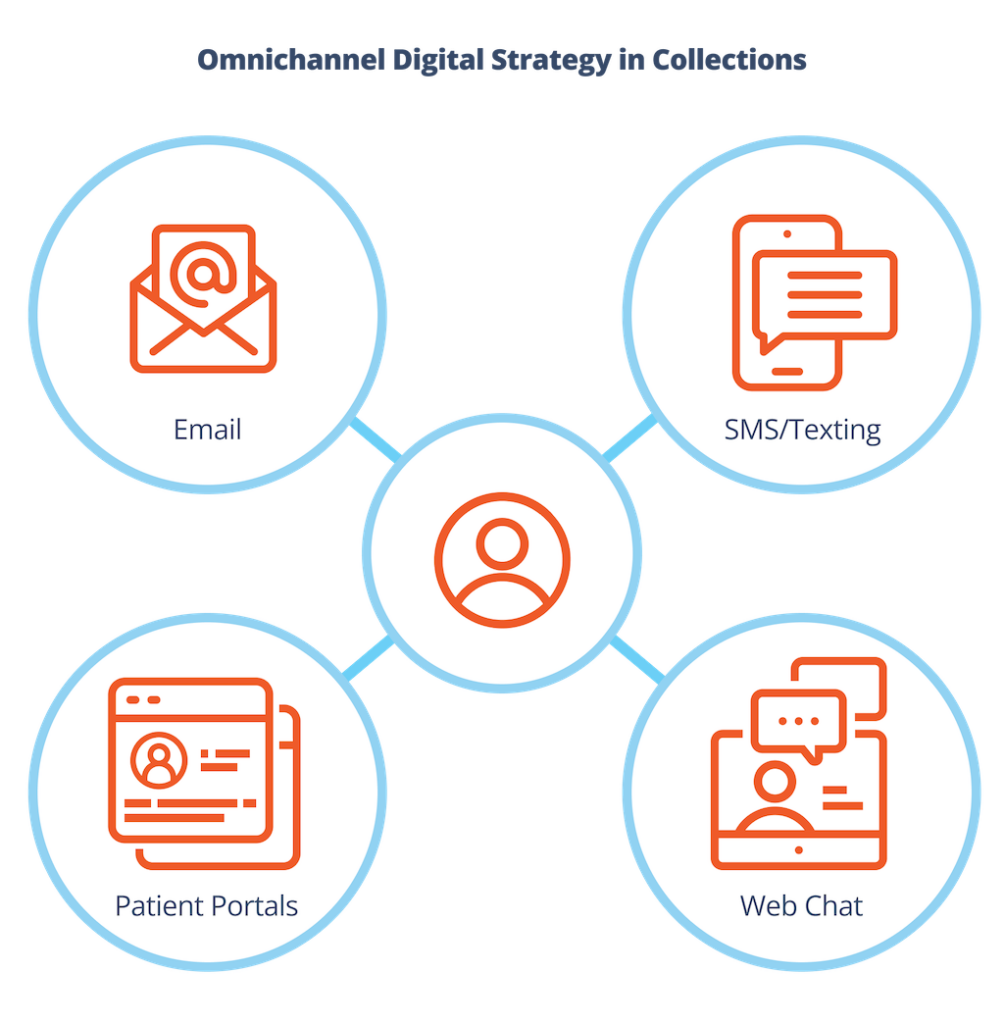

Effective digital patient communication tools include email, SMS/texting, web chat, and patient portals. In the following sections, we’ll take a closer look at each method.

Email Strategies for Effective Communication

While email has taken a backseat to mobile messaging in terms of frequency used, it’s still an integral part of most Americans’ daily lives.

One notable issue for RCM teams using email to communicate with patients is the need for a HIPAA-compliant system. There are many email tools that meet this standard on the market, and engagement platforms that are designed for healthcare billing should already be compliant with this rule (although it’s always important to confirm!).

Email notification systems can be useful because RCM teams can set up responsive campaigns to notify patients that a payment is due, then thank them for their payment when received, or trigger another notification email if a payment isn’t received. This allows for both personalization and automation—the best of both worlds when it comes to omnichannel debt collection.

Another benefit of email communications is their creation of a “paper trail,” albeit an electronic one, which can be highly useful for documentation purposes.

Maximizing SMS and Instant Messaging

One of the biggest benefits of SMS and instant messaging for payments is immediacy. While people check their email about 15 times per day, research has found that the average person checks their phone up to 144 times per day.

Add to this the survey finding that 32 percent of people will pay a bill via secure text within five minutes of receiving it, and it’s clear that neglecting text-to-pay options means leaving a lot of money on the table.

Texting is also ideal for two-way communication, as it offers a fast and convenient way for patients to communicate with your team. You can also set up automated replies to specific common inquiries, and escalate more difficult questions to your human debt collection team.

Live Chat and Chatbots for Real-Time Engagement

Of course, some patients will always prefer speaking to someone from your team in real time, which is where live chat and chatbots come in.

While these patients may overlap with those who prefer phone communications, many patients prefer web chat because it’s less intimidating. There’s more anonymity on a live chat, which can be appealing for patients who don’t want to be judged for being behind on their medical bills. And of course, live chats typically don’t have lengthy hold times like phone calls to a call center can.

To get the most efficiency out of your live chat, opt for a system that includes automated chatbots as well as chat with human representatives. Chatbots are fast and available 24/7, so they can answer your patients’ most basic or frequent questions, funneling more complex questions to your representative for further communication. Chatbots can also handle a large volume of requests at the same time, freeing up your team to answer your patients’ more nuanced and complex questions.

Remember: If you choose to use chatbots, you should review your strategy with a partner that specializes in debt collection AI to ensure that your technology meets all the required laws and regulations.

Patient Portals for Empowered Self-Service

While patient portals have been mainstream for several years, they are most often used to give patients access to medical records or test results, not the ability to make payments on their bills.

Adding a billpay or payment plan option to a patient portal can go a long way toward shortening your revenue cycle. A report by U.S. Bank found that the largest percentage of users who accessed their patient portals did so for payment and billing purposes—44 percent accessed their portal to pay their bills, while 42 percent used it to check their balance and payment history.

The biggest appeal factor for a patient portal is the self-service aspect, which has become more important as more industries have implemented self-service billpay.

Integrating Data Analytics for Enhanced Engagement

Debt collection analytics—descriptive, diagnostic, predictive, and prescriptive—are an essential element of offering personalized, two-way patient communication. Without the right data, it’s impossible to understand your patients’ preferences or offer payment plans that will work for their specific circumstances.

At Revco, we always request as much demographic data as possible, not only for compliance reasons but because it can greatly increase the likelihood of ultimately collecting payment. With complete and accurate data, our team members can gain a clearer understanding of patients’ needs and ability to pay, resulting in a more compassionate and efficient outreach strategy.

Analytics are also key for tracking how successful specific electronic communication types are. Our team has found that switching to SMS communications with patients who have failed to pay after being contacted in other ways has increased payments.

performance-driving RCM insights?

Crafting an Omnichannel Digital Strategy

When developing an omnichannel approach to collections, you’ll want to make sure it includes these elements:

- Self-service options: Text-to-pay, patient portal

- Representative-assisted options: Live chat, email, phone

- Multiple payment types: Credit card, ACH

- Data analytics: Collection of patient communication preferences

You may need to work with different partners to integrate different payment options.

The first step in effectively implementing an omnichannel collections strategy will be gathering your patients’ communication preferences. From there, you can move through the collection process using that preferred communication form, switching to another if payment is not collected promptly.

Legal Compliance and Ethical Standards

It goes without saying that every communication partner you work with needs to be compliant with HIPAA as well as regulations relating to online payment security, debt collection, and patient privacy.

Representatives must always use the same ethical standards for respectful communication via text, email, or chat that they would on the phone.

And because communications in writing don’t have the benefit of tone of voice to convey a message, it’s a good idea to implement training on the various communication methods, even for your seasoned representatives. Make sure they have the same types of support (scripts, personal information, etc.) when using electronic communications that they have when reaching out via phone.

Boost Your Revenue With Revco’s Patient-First Collection Services

At Revco, our collectors are committed to creating an extraordinary patient financial experience. Our skilled representatives are trained to communicate with compassion and give patients payment options that work for them, allowing us to recover as much cash as possible while reinforcing the trust you’ve built with your patients.

We’d love to partner with you. If you’re ready to pursue unprecedented financial success, reach out to us today.