Every healthcare organization wants to maximize patient collections. The challenge is getting RCM staff throughout the entire patient journey, from registration and check-in to discharge and follow-up, invested in meeting this goal.

It’s not enough to simply improve patient communications or streamline the billing process. Instead, organizations must commit to a full suite of patient-centered strategies over the long term—a daunting task, no doubt, but one that is both necessary and worthwhile in an era of increased claim denials and higher patient costs.

The Benefits of Improved Patient Collection Processes

Improved collection processes offer a host of benefits for both your organization and your patients.

A Stronger Bottom Line

The first benefit is, of course, a better bottom line. If you’re able to collect a greater percentage of what patients owe, your organization will be financially healthier and experience sustainable growth, which in turn allows you to improve your patient care and services.

Improved Patient Satisfaction

When patient collection strategies are firmly patient-centered—in other words, rooted in empathy, flexibility, and personalization—patient satisfaction increases.

And this is an area where there’s plenty of room for improvement: According to a survey by the American Academy of Physician Associates, 65 percent of patients said that coordinating and managing healthcare is overwhelming and time-consuming. Making the payment and collections process as simple and painless as possible can go a long way toward giving patients a memorably positive experience.

Shortened Revenue Cycle

When patient debt can be collected earlier, your revenue cycle is shortened and cash flow is healthier. What’s more, when your team can spend less time following up on debt, they have more time to invest in each patient interaction. This can result in additional increases in your team’s ability to collect early, creating a positive, self-sustaining cycle.

Stronger Long-Term Financial Sustainability

Maximizing patient collections will also put your healthcare organization in a stronger long-term financial position. With the continued changes coming out of health insurance, including fewer and lower payouts, being able to weather economic ups and downs is more important than ever.

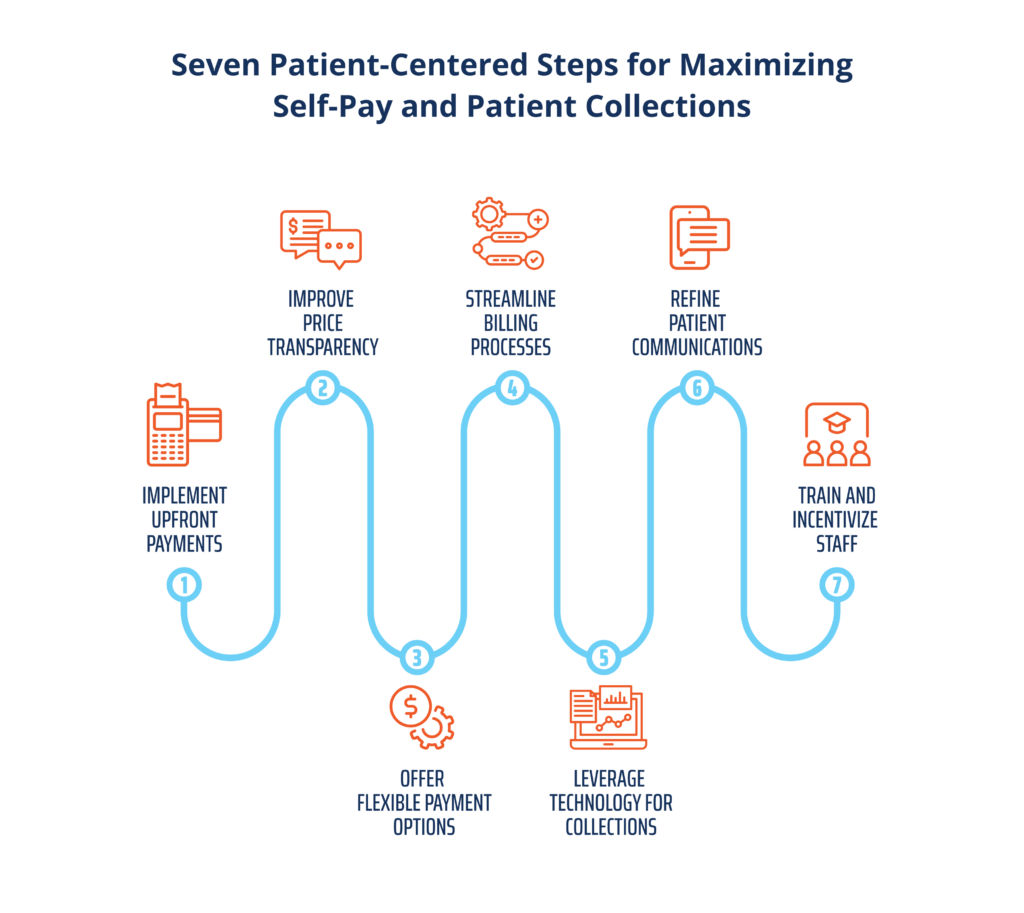

Seven Patient-Centered Steps for Maximizing Self-Pay and Patient Collections

Your hospital or clinic may already have implemented some of these steps in isolation, or even as part of a larger plan.

Even if you are already using these strategies, remember that the real results will come from taking a patient-first approach to each one. That’s the key to our work at Revco: we begin from a place of service to others, which allows our staff to always put the patient first.

Step 1: Implement Upfront Payments

Upfront payments can have a significant effect on improving your cash flow. In fact, a report on healthcare self-pay collections by Crowe found that more than 57 percent of bad debt is attributable to self-pay after insurance accounts.

In order to effectively implement upfront payments, staff need access to accurate patient estimates, not to mention the early out technology and training needed to understand and clearly communicate insurance co-pays and coverage.

This is especially true given that 58 percent of insured adults in a recent KFF survey reported having problems with their insurance in the past year, whether due to issues with their provider network, coverage, or pre-authorization. Considering that many healthcare providers also report having issues with insurers, this is a critical area for examination and improvement.

Step 2: Improve Price Transparency

Greater price transparency has been a mandate for healthcare providers since the implementation of the federal No Surprises Act in 2021, but most medical practices still have a long way to go in terms of giving patients accurate, upfront price estimates.

Many of the reasons for this have more to do with complex, constantly changing payer policies and the structure of the U.S. healthcare system than with the providers themselves. However, if hospitals and providers can find the resources, in terms of staff and time, to invest in improving their price transparency and accuracy, they can reap real benefits.

One of the biggest benefits? Patient retention. According to one report, 60 percent of patients said they would consider switching healthcare providers after receiving an inaccurate estimate or a surprise medical bill.

Step 3: Offer Flexible Payment Options

Flexible payment options are an absolute must-have in today’s healthcare ecosystem. That includes not only flexible methods of payment, like text-to-pay and a user-friendly patient portal, but also options for cost management, such as payment plans and partial upfront payments.

A PYMNTS report from 2021 found that:

- 63 percent of patients want access to payment plans

- 54 percent of patients want to manage their payments digitally

- 33 percent of patients would switch medical providers if it meant they could establish a payment plan

Step 4: Streamline Billing Processes

Considering how complex medical billing can be, the best way by far to streamline your bills—and to produce easy-to-read, concise billing statements for your patients—is automating your billing with RCM tools.

By automating functions like coding and claim submission, your team can greatly reduce the amount of time spent on patient services billing while improving the patient experience.

Step 5: Leverage Technology for Collections

RCM data analytics is a powerful tool for maximizing patient collections. The insights gleaned from a robust data analytics program can help your team

- Predict patients’ propensity to pay

- Identify patients who may be eligible for financial assistance

- Determine the most efficient and effective way to communicate with each patient

- Predict trends and patterns that can influence organization-wide collection strategies

Step 6: Refine Patient Communications

Just as patients want a variety of options to pay their medical bills, they also want to communicate through their preferred method, be it text, email, phone, or chat.

Adopting this omnichannel communications strategy, and allowing patients to voice their preferences early in the patient journey will vastly improve your patient experience, and make it easier for patients to pay their bills when they’re due.

Step 7: Train and Incentivize Staff

If your staff are going to be able to improve patient collections, they must have the tools and support they need. That means letting staff know that their assessments don’t rely solely on speed and number of patient interactions, but more on call quality and patient experience.

Taking a patient-first approach to collections also means training staff in empathetic methods of collection, giving them ongoing training in payer policies (which change often), and ensuring that they have access to a knowledge base that helps them fill in any knowledge gaps.

Measuring Success in Patient Collections

There are plenty of KPIs that are typically used to determine success rates for collection representatives—talk time, for example.

However, at Revco we’ve moved away from many of the more traditional representative KPIs because they don’t measure what’s important: patient experience and the quality of contact.

Team-wide KPIs that measure things like the rate of collection and days outstanding are always important, and play a major role in determining how a patient-first collections strategy is performing.

KPIs that can help you determine your own rate of success in maximizing patient collections include:

- First Call Resolution (FCR): How many debts are resolved in the first call (or interaction)

- Success rates for different methods of communication (phone, text, mail, etc.)

- Right Party Contact (RPC): The percentage of calls that are connected to the intended recipient

- Close rate for RPCs: How many of the RPC calls are closed, with 20 contacts and 10 promises to pay as a good benchmark

- Call quality: This can be measured through a speech analytics program, which can identify indicators of customer emotion and sentiment through AI. These insights into what works and what doesn’t can then also be used to train other representatives.

Standard collections KPIs for your organization at large include:

- Average days in accounts receivable (A/R)

- Aged A/R rate

- Gross collection rate

- Bad debt rate

- Cost to collect

- Point-of-service collection rate

The bottom line will always be how much revenue you’re able to collect. If a representative is on the phone with a patient for longer than industry standards, yet they’re collecting payments successfully, that’s what really matters.

Learn More About How to Maximize Your Patient Collections

Maximizing patient collections is a process that takes both time and organization-wide buy-in—but if you commit to this kind of patient-first approach, both your patients and your healthcare organization stand to benefit.

If you’d like to learn more, check out these related pieces:

- Aligning Your Revenue Cycle with the Patient Experience

- Digital Channels: The Key to Enhancing Patient Debt Recovery.

Or, if you’re ready to pursue unprecedented success in your collection efforts, reach out to our team today.